Sales taxes rebound in October

After a sluggish September quarterly report, sales tax revenues to local municipal and county governments shot up in October, improving prospects for an end-of-the-end upswing.

The seven Barry County cities collecting sales tax received $849,778.81, up 18 percent from a year ago. Only Seligman and Washburn slipped below last October.

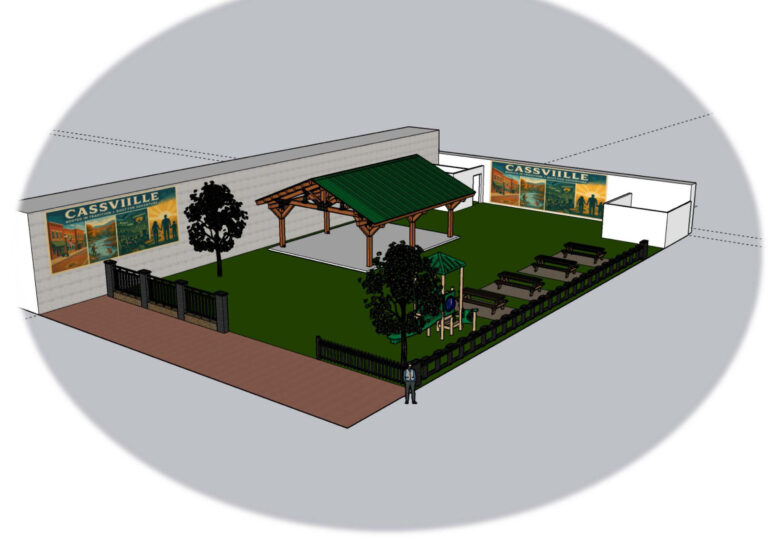

Cassville extended its gains to 16 consecutive months, receiving $149,101.78 from its 1 percent general fund tax, up a whopping $42,512.43, or 40 percent, from a year ago for a new October record. Steve Walensky, Cassville city administrator, said the uptick in October revenue was the result of an audit of a local merchant and a multi-year adjustment being paid.

For 2023, Cassville’s general fund total is up by nearly $96,000.

Seligman saw its sixth drop in its general fund revenues in the past seven months. The city’s 1 percent tax received $9,358.27, down $2,3391.81, or 20 percent. For the year, Seligman’s general fund revenues are down by almost $3,000.

The Purdy 1-percent general fund sales tax yielded $6,252.35, up $1,344.16, or 27 percent, from a year ago. It was the second largest October payment since the city switched to one tax supporting its general fund in 2010. It was the third gain in six months. For 2023, Purdy’s general fund total trails last year by a little over $400.

Both Wheaton’s erratic sales taxes saw their second gain in six months. The city’s 1 percent general fund tax yielded $5,960.87, up $1,649.07 from last October. The half-cent transportation tax saw gains of almost a third of that amount. Wheaton’s general fund in 2023 lags behind last year’s pace by more than $19,500, or 34 percent.

Washburn’s 1 percent general fund tax produced $2,745.80, down $291.55 from last October for the fifth drop in six months. The 2023 sum has still outpaced last year by almost $10,000.

Exeter received $2,705.59 from its 1 percent tax, up $916.37 from a year ago. That’s only the second gain in seven months, putting the 2023 total a little more than $2,000 under last year’s pace.

Monett broke out of a four-month slide, something the city hasn’t seen since the economic downturn in 2009, with $223,286.50 generated by its two sales taxes for the general fund at a combined rate of 1 percent. That sum was up $38,423.50, or 21 percent, from last October for a new October record. That boosted the seven-month general fund total for the fiscal year up to just 2 percent below a year ago.

Monett’s general fund 2023 sum is now more than $87,000 ahead of 2022 at this time.

Barry County’s countywide half-cent sales taxes for general operations and road maintenance each generated more than $238,774, each up by more than $14,600, or 6.5 percent. For the year, revenues from those taxes are down by around $9,000 from a year ago.

Barry County’s law enforcement sales tax generated $218,322.68 in October and in 2023 has produced $2,262,160.79. In its first three months of start-up collections at the end of 2022, the tax collected a total of $197,634.13. This year, the tax has generated more than that every month.

Barry County’s separate sales tax of .375 percent, which goes directly to pay for central dispatching and 911 services, generated $179,043.62 for the month. That was up almost $11,000, or 6.5 percent, from a year ago. That put the tax total for the year down a little more than $8,000 from a year ago.